The world is changing rapidly due to technological advancements, forming a digital reality called the new normalcy with unique properties. Among them are remote work, use of AI, online gadgets, and cryptocurrencies.

The new normalcy is a 21st century's phenomena. Twenty years ago no one could imagine that a single smartphone could replace a camera, calculator, music player, navigator and other pocket devices. It connects its owner with any person on Earth, contains all existing human knowledge, and makes it possible to share Wi-Fi to earn money in crypto. To do so, install ByteLixir for PC, laptops, smartphones, etc. for passive income without effort or risks. The funds accumulate on your personal ByteLixir account. This is a sum suitable for buying goods or services online, exchanging it for conventional US dollars, Euros, Chinese Yens, etc. Our ethical application for selling your bandwidth is only a single example of how cryptocurrency impacts our society.

Blockchain and cryptocurrency explained by the ByteLixir bandwidth-sharing app

Basic understanding of cyberfinance technology is crucial to manage your well-funded future. The global cryptocurrency market makes up more than $2 trillion, it is almost twice times larger than the value of all the Earth’s silver. And apart from spending hours in silver mines, collecting digital capitals requires just an internet connection for mining BTC or selling bandwidth for crypto.

Blockchain is the ground technology. Imagine it as building a brick house:

- Every brick is a metaphor for a financial transaction. It is placed in correct order forming a wall regarded as a crypto block.

- Once a wall is completed, workers attach it to previously built walls forming a continuous composition, a blockchain.

- Smart contracts’ play the role of a mix mortar. These self-executing programs conduct virtual payments from stocks, other users, bandwidth-sharing apps, and so on.

- A group of contractors who build walls are called miners. Each builder follows the uniform norms according to the house's blueprints (mining algorithms), and it is an example of how decentralization works. All participants share responsibility to ensure future building meets the demands of transparency and safety.

- Each new brick contains information about all previously mounted fragments, thus are e-money transactions. Replacing or adjusting bricks is impossible, as it contradicts construction standards — cryptographic hash with all bricks’ positions and unique numbers written. This eliminates failure or corruption risks.

- Becoming a distributed ledger’s developer leads to the possibility of earning passive income from computer, but requires special skills or savings:

- The Proof-of-Work (PoW) pattern asks miners to solve complex puzzles for adding new bricks.

- The Proof-of-Stake (PoS) method means that the chief engineer (a cryptocurrency creator) selects builders considering their investments in monetary schemes. The more building materials (coins or tokens) they stake, the higher profit is.

Our platform operates the same principle, yet an additional profit is available to everyone. When you get ByteLixir for computers or smartphones, these gadgets become a part of user communities who share Wi-Fi and earn money in certain geolocations. We pay rewards according to blockchain techniques and operate the service in strict compliance with KYC and AML rules.

- Users store their virtual resources in secure wallets:

- Hot, which are software-based systems, online or local,

- Cold, understood as physical storage units, hardware-based.

A private key (a secret code) is required to manage and spend crypto assets, while others send money to you using a public key (wallet’s address consisting of letters and digits).

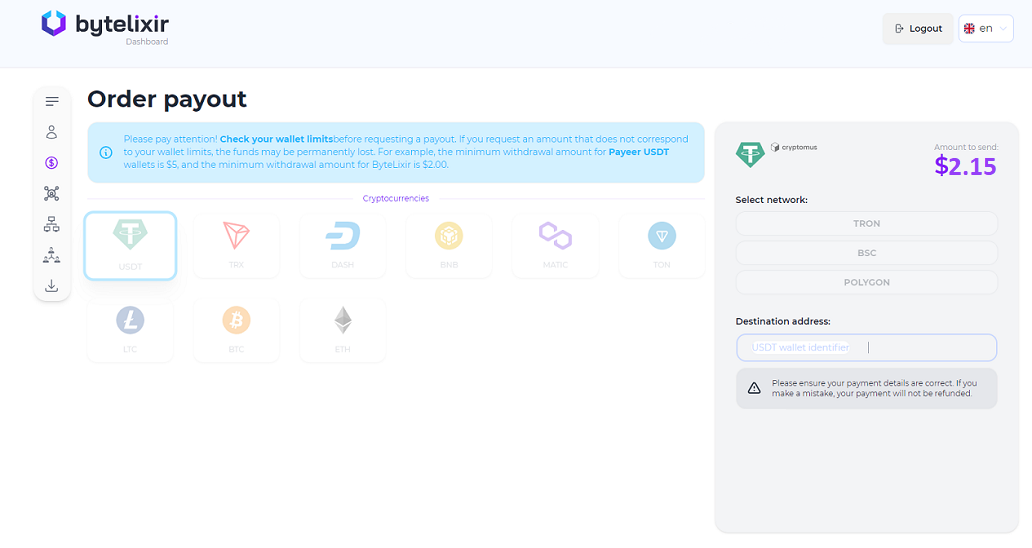

Selling your bandwidth brings $2–4 from a single device with a minimal payout threshold of $2. There are various currencies to get, and the choice is yours.

Coins offered for payout by the ByteLixir bandwidth-sharing app

Coins offered for payout by the ByteLixir bandwidth-sharing app

What cryptocurrency to choose: types of coins and tokens

More than ten thousand types of crypto are traded online. Remittances' creators are:

- Enthusiastic individuals

- Corporations

- IT communities known as DAO, decentralized autonomous organizations.

Ethical applications offering to earn money (by selling internet for crypto or performing gig economy’s tasks) usually operate proven currencies with low volatility.

Depending on the origin of blockchain adopted for operating internet cash, there are crypto:

- Coins, based on their own infrastructures (BTC, LTC, ETH, BNB, DASH). These are self-confident buildings with almost unlimited number of floors.

- Tokens, leveraging verified third-party networks. USDT, TRX, Polygon, TON exist as other constructions’ annexes. They operate the same bricks as parent frameworks.

Categories of electronic payments are:

| Category | Examples | Description |

| Digital gold | Bitcoin (BTC) | The first cryptocurrency in history, still occupying half of the whole market |

| Smart contracts | Ethereum (ETH) | The decentralized ledger’s development underlying decentralized applications (dApps) |

| Private finances | Monero (XMR) | Specializes in performing private transactions |

| Stablecoin assets | Tether (USDT), USD Coin (USDC), Dai (DAI) | Such finances tie their rates to the US dollar. They tend to be more stable than other electronic money. This makes stablecoins useful for accumulating earnings from bandwidth-sharing apps, mining, etc. |

| Utility tools | KuCoin Shares (KCS), Binance Coin (BNB), Huobi (HT) | Applied within cybernetic exchange portals (such as Kucoin, Binance, Coinbase, Huobi) for paying fees, obtaining profit from airdrops, participating lotteries, and more |

| DeFi assets | Uniswap (UNI) | Popular within decentralized web resources. Enables trading electronic capitals without intermediaries |

| Gaming and NFTs | Axie Infinity (AXS) | Serve as parts of play-to-gain gaming ecosystems. |

Cryptocurrencies’ use cases: payments for selling your bandwidth

Cryptocurrencies serve for multiple real-life applications across different industries. When users download ByteLixir on laptops or smartphones and share bandwidth, they collect tokens and coins as standard means of payment. Other real-life use cases involve:

- Payments and transactions

- BitPay: processor that enables businesses to accept Bitcoin and altcoins.

- Overstock: online retailer enabling customers to buy goods with virtual gaining.

- Gaming and entertainment

- Decentraland (MANA): VR platform to buy, develop, and trade virtual real estate through electronic finances.

- Hamster Kombat: game to obtain points (HMSTR) through tapping the screen, which you can exchange to other currencies. Selling your bandwidth, taking online tests, trading 3D art, and so on leads to remuneration in more conventional currency.

- Enjin Coin (ENJ): a means of payment that enables creating and trading virtual goods.

- Remittances

- Ripple (XRP): protocol facilitating cross-border transfers at low costs.

- Decentralized Finance (DeFi)

- Aave: DeFi solution specializing on lending and borrowing web finances without intermediaries.

- Compound: decentralized lending protocol offering interests from online holdings.

- Charity and donations

- The Giving Block: portal assisting charitable organizations in raising donations.

- Digital identity

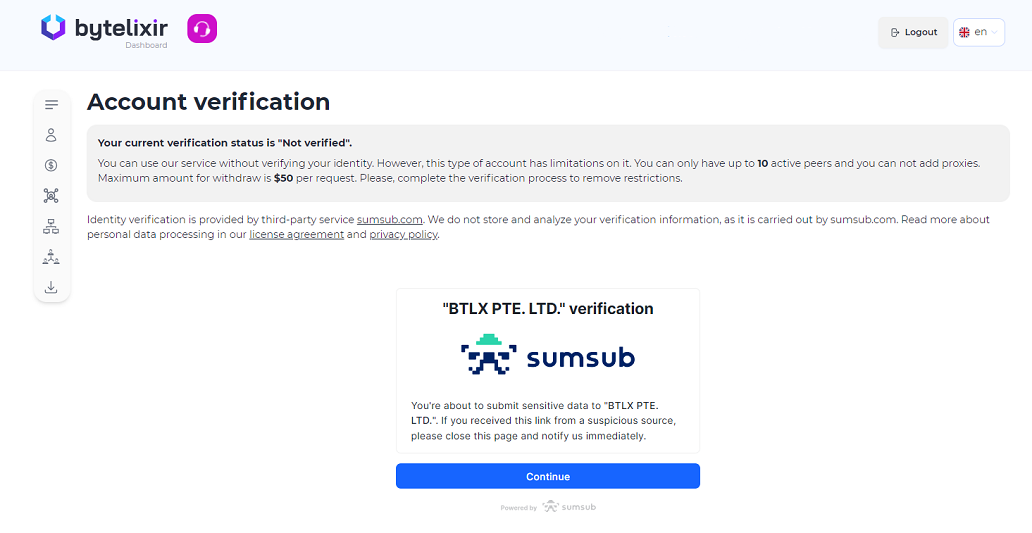

- Civic (CVC), U-Port: blockchain-based identity verification sites. They opt for managing and sharing personal information securely across different platforms. The similar tactic follows our sell-bandwidth-for-crypto-app, which doesn’t collect or trade personal info, but allows to pass verification through dashboard via Sumsub solutions for extra passive income opportunities.

Raised number of peers to connect, ability to earn from proxies and payout more than $50 at once are the bonuses of passing verification

How does cryptocurrency affect society, global financial systems and economies?

Cryptocurrency is a special case of applying blockchain, just like the ByteLixir app to install on PC on Windows or Android is a real-life example of utilizing internet cash for paying remuneration for shared bandwidth.

Speaking about the impact that virtual assets have on society, there are multiple spheres to focus on:

| Aspect of cryptocurrency application | Description | Real-life cases | Possible consequences |

| Financial inclusion |

|

M-Pesa integrated with BTC | Expanded access to finances in regions with absence of banking infrastructure. Earn money sharing Wi-Fi, if there is any |

| Investment opportunities | Internet assets are available for investing with high interest and risks | Bitcoin futures (CME), Bitcoin ETFs | Investment avenues for institutional and retail investors |

| Monetary policies | Digital analogs of fiat currency (CBDCs) by central banks | China’s electronic yuan (e-CNY) |

|

| Disintermediation | Peer-to-peer exchanges dispose of intermediaries | MakerDAO, Uniswap | Lowered transaction costs with increased velocity |

| Enhanced security and transparency | Immutable ledger ensures secure and transparent transactions, reducing fraud | IBM Food Trust | Deposits’ increased safety accompanied by bandwidth-sharing app’s AML and KYC strict compliance |

| Blockchainization of traditional banking | Banks are integrating decentralized architecture to stay competitive | JPM Coin by JPMorgan Chase | Possible merging of fiat and crypto transactions |

| Wealth redistribution | New avenues for wealth creation and redistribution | ICOs, pre-sales |

More equitable access to investment and profit-obtaining opportunities leads to:

|

| Impact on remittances | Decentralized tokens are a low-cost alternative for sending remittances, benefiting migrant workers and their families | Bitcoin remittances in the Philippines and Central Asia | Increased monetary support of developing regions with a perspective of their further progress based on gig economy and methods to sell bandwidth for crypto |

| Regulatory evolution | Updated regulatory frameworks for web currency | EU MiCA Regulation |

|

| Corporate adoption and payment systems | Corporations are beginning to accept cybermoney as payment | Microsoft, AT&T, Starbucks, Tesla |

|

| Geopolitical impact | Impact on geopolitical dynamics by establishing alternative financial systems | Iran, Venezuela, Russia |

|

| Environmental concerns and innovations | Mining’s environmental impact leads to interest in sustainable innovations | SolarCoin, Chia |

|

Cryptocurrency earning methods

Ways to earn crypto include stock-based methods and remuneration for commercial activity.

Stock-based techniques are:

- Mining: gaining rewards for processing transactions on a blockchain network

- Staking: locking up a certain amount of electronic finances to support the system’s operability

- Trading: buying monetary titles at drawdowns and getting rid of them at rises

- Airdrops: obtaining free wallet top-ups during promotional campaigns

- Lending a part of digital portfolios to borrowers in exchange for interest payments.

The example of topping up a wallet with additional internet bucks is selling bandwidth for crypto, a safe and ethical passive income practice. Check out how ByteLixir works on the official YouTube channel:

E-money sources based on rewarding activity are:

- Playing games and testing them

- Completing microtasks, such as passing surveys, creating content, completing captchas, and watching ads

- Freelancing to get paid in cybercash

- Running a master node, which includes operating a specialized server to assist bitcoin operation

- Participating in bounty or affiliate programs through inviting new users for commissions. For example, you offer to:

- Create account on the official site

- Download Windows or Android versions of ByteLixir through your partner link

- Utilize the app.

Then you get a reward equal to half of your active partners’ income.

Cryptocurrency impacts financial, environmental and legislative spheres of society, democratizing monetary operations. Participate in the growing ecosystem of electronic finances with the ByteLixir bandwidth-sharing app to make a step into the future of online passive income.